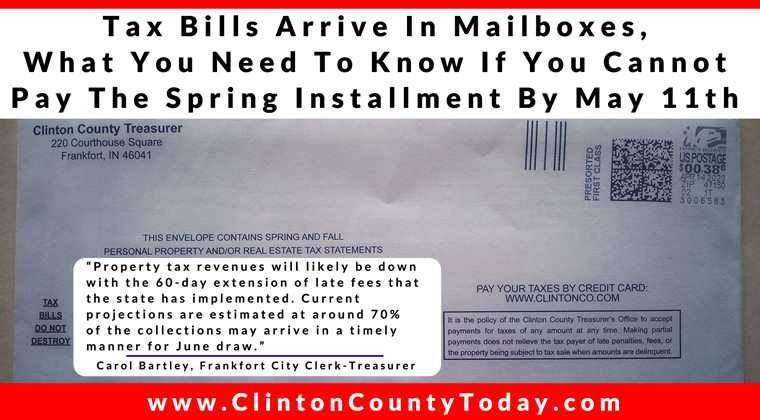

Across Clinton County, real estate owners opened their mailboxes to find the 2019 Pay 2020 tax bill.

This year due to COVID-19, Indiana Governor Eric Holcomb is providing some help to some real estate owners.

The real estate tax assistance is for non-escrowed real estate owners. Non-escrowed owners are those that do not make property tax payments through an escrow account or mortgage company.

Governor Holcomb issued Executive Order #20-005 on March 19, 2020. In that E.O., Section 6(B) mandates that all counties waive penalties for delinquent non-escrow property taxes paid within sixty (60) days after May 11, 2020, the May installment due date.

So what does that mean for you, the non-escrowed property owner?

One, property taxes remain due on May 11, 2020, however, counties are to waive penalties on payments made after May 11, 2020, for a period of 60 days.

Two, you must make your payment on or before July 10, 2020, to avoid any late penalties.

The Indiana Department of Local Government Finance (DLGF) sent out a memorandum to every county in the state, “each county shall waive any penalties for any property taxes paid within sixty (60) days after the statutory deadline; therefore, the spring installment may be paid up to and including July 10, 2020, without penalty.”

The Governor and DLGF encouraged taxpayers to make timely payments (that is, on or before May 11, 2020) in order to ensure orderly operations of government.

Frankfort City Clerk-Treasurer Carol Bartley stated during the Monday, April 13, 2020, City Council meeting, “Property tax revenues will likely be down with the 60-day extension of late fees that the state has implemented. Current projections are estimated at around 70% of the collections may arrive in a timely manner for June draw.”