FRANKFORT, Ind. – The Frankfort School Board Tuesday evening voted unanimously to set December 13 for a public hearing on a planned $32.5 million bond for districtwide renovations.

The issuance of the new bond will not increase taxes and will address many issues with the Frankfort Middle School (FMS) being the primary benefactor of the monies – a two-year, $25 million renovation that could begin as soon as the summer of 2024.

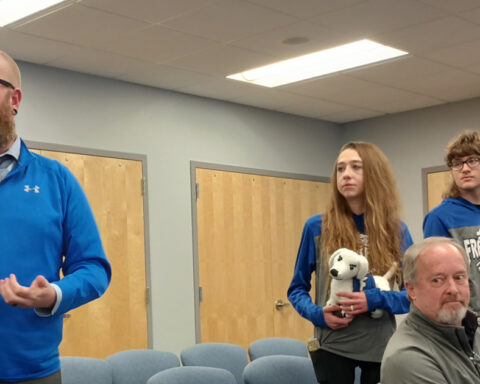

Community Schools of Frankfort Superintendent Dr. Matt Rhoda explained the areas of FMS planned for renovations while addressing the board, “there’s a safety concern regarding the location of the current office in relation to the front entrance. The roof is in very poor condition. There’s insufficient restroom space for students to use throughout the building. The music wing that houses orchestra, band, and choir are too small and lack storage space for instruments. Classroom instructional space will also need to be right sized. There are other projects in the district that will need attention at the same time, which includes the repair of the Suncrest roof.”

Dr. Rhoda described the timing of these projects is to take advantage of the “next debt drop off and the debt service fund in 2024.”

After the meeting, Dr. Rhoda provided a breakdown of the maximum bond amount to be requested.

“It’s a little over $32 million that we’re taking out – that $32,525,000 – because we want to have $30 million for projects. So the $2.5 million is really for all of the soft costs from architecture to all of the other preconstruction needs that take place. So we want to have $30 million to be able to put $25 [million] towards the middle school, and then another five [million] towards things that need done immediately, for example, like the Suncrest roof.

When asked about his comment of the bond used to pay for the projects “will keep everything tax rate neutral, and there will be no, again, no increase to tax rate,” Dr. Rhoda shared how the retired debt amount would negatively impact CSF in the future when the debt retires as tax rates would go down and trigger a referendum to do projects at a later date.

“Our tax rate goes down, which means that if we want to do any big projects in the future, we would have to go the referendum route to raise that tax rate again in order to be able to generate those funds. And so we want to stay tax neutral so that we are able to continue to use debt drop off to be able to fund future projects without going to the public to ask for a tax increase.”